Financial Advisor Penrith

Your local Penrith Financial Planners and Advisors

Financial advice to create your path to wealth

Who are we?

Creo Wealth is a family-owned and operated business. Anthony Sultana is a financial advisor in Penrith who enjoys a love affair with numbers. And Kylie Sultana is the practice manager and organisational queen.

Anthony’s goal is to remove the ‘one size fits all approach’, providing tailored advice that’s specific to you. And Kylie’s on a mission to help you understand your money story and give you the tools to start rewriting it.

Are you making the most of the cash and assets you have?

Are you thinking about or are already investing but want to make sure you’re making the right choices?

Have you protected yourself and your loved ones in case the unthinkable happens?

Or are you wanting to improve your financial situation but don’t know where to start?

Whether you’re a budgeting beginner or financially cruising along, we can help. At Creo Wealth, we’re all about empowering you, whether you’re young or old.

We believe that creating wealth isn’t only for the rich or well-paid. It’s for everyone regardless of your income or what you do for a living.

It’s not about how much you earn but making the best use of it.

So, if you’re after a financial advisor in Penrith, you’ve come to the right place.

How we help

You don’t need to be rich or earn heaps of cash to start (or continue) your wealth creation journey. After all, it’s not about what you earn but what you choose to do with it.

And here’s how our Penrith financial advisors can help you with your wealth creation:

Investment planning & Wealth creation

Making your hard-earned cash work hard for you. We’re all about having a wealth creation plan that delivers.

Personal risk insurance

Helping you protect yourself and your family if the unthinkable happens.

Aged care financial planning

Alleviating the emotional and financial toll of moving yourself or a loved one into aged care.

Money management course

Want to learn how to get in control of your money instead of letting it control you?

Our values

Passion

We have a passion for numbers and helping you reduce the fear that comes with managing your finances. The result? You can walk your journey towards financial freedom with more confidence.

Knowledge

Ensuring our team is up to date with relevant knowledge. And spending time to educate you, so you can make informed decisions about your financial future.

Solutions

Presenting you with solutions that best suit your circumstances and your financial goals. No cookie cutter financial planning advice here.

Commitment

We’re committed to helping you discover what financial freedom means for you. And we’re committed to helping you get there.

Integrity

At Creo Wealth, integrity is the name of the game. We’re huge believers in acting honestly and with integrity. After all, you need to work with a financial planner you can trust.

Respect

Financial planning and wealth creation can feel so overwhelming. Which is why we treat our team members and you as our client with respect. After all, we’re all human.

Testimonials

I can’t possibly say enough good things about Anthony and his financial knowledge. Anthony helped us with a solution to a problem that no other financial planners had even thought of. His great thinking and ideas have helped my father receive extra earnings that we figure could add up to over $100,000 that he would otherwise not have had, if we hadn’t gone to Anthony at Creo Wealth. If you need any financial advice, we cannot recommend enough that you talk to Anthony. If you don’t, you may end up losing out like my father did before we met him. Our family can’t thank you enough!

After meeting with Anthony and Kylie from Creo Wealth, you can tell they genuinely care about their clients and helping them to succeed. They really know their stuff and I would recommend them to anyone looking for an amazing financial advisor.

NEVER WORKED WITH A FINANCIAL PLANNER BEFORE?

How we work

Well, here’s a sneak peak at how we work

Get to know you

Either face-to-face in our Penrith office or over Zoom.

Goal-setting

Setting goals is an important part of the process. It’s not simply about getting to know your finances. We get to know you and what’s driving you.

Number crunching

We have a real love affair with your numbers. This allows us to tailor our advice to you specifically.

Let's get started

This is all about implementing your plan and ensuring no circumstances have changed since we first met.

Walk with you on the journey

Here’s where your journey to financial freedom really begins. And we’re here to help you on your journey.

The financial blog

Our recent insights

Breaking the Money Taboo

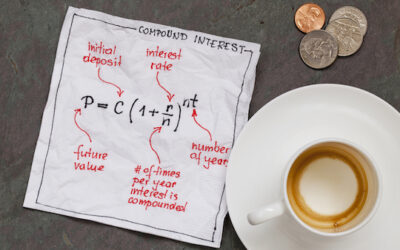

Compounding interest on savings accounts: what is it and how does it work?

Re-Gifting. Is it all that bad?

Let’s face it, holiday gift-giving is a mixed bag. What if there’s a way to turn unwanted gifts into a win-win? Enter re-gifting.

Areas we service

Riverstone | Penrith | St Marys | Richmond | Marsden park | Kurrajong | Windsor | Luddenham | Orchard Hills | Glenbrook | Springwood | Mulgoa | Blacktown | Jordan Springs | Werrington

Are you ready to make your cash work hard for you?

Why leave your finances to chance? There’s no better time than now to improve your financial future. Book an obligation-free chat or give us a call on (02) 9629 1866 and see how we can help you create and protect your wealth.